The South African Reserve Bank (SARB) has opted to keep its main lending rate unchanged at 6.75% during the Monetary Policy Committee (MPC) meeting held on Thursday, aiming to further monitor inflation expectations before any potential shifts in monetary policy, reports Cape {town} Etc.

This decision follows a prior reduction from 8.25% at the beginning of 2024, showing an intention to maintain stability amidst a complex global economic landscape.

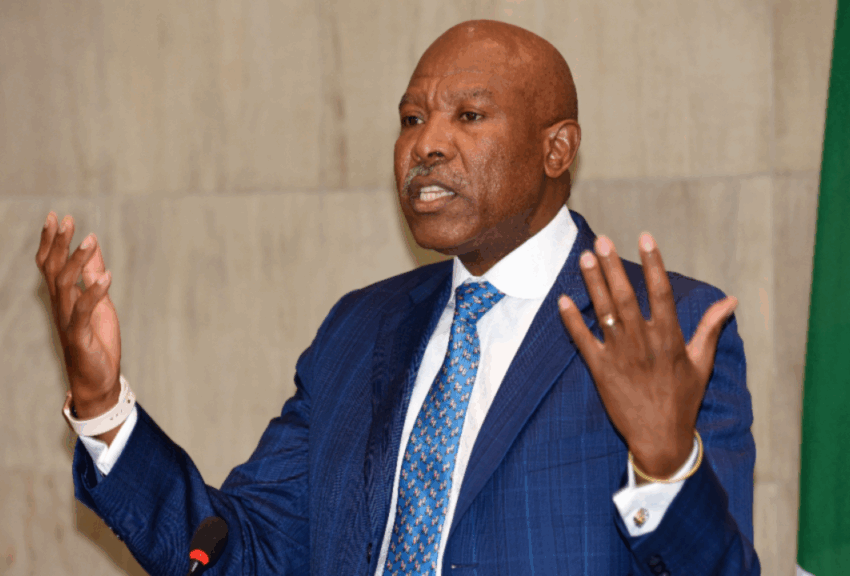

Reserve Bank Governor Lesetja Kganyago remarked that 2025 was a year fraught with global uncertainty, a trend that has seemingly carried into 2026 with renewed geopolitical tensions hinting at a fracture within the international political order.

Such instability, coupled with emerging risks such as a potential AI market bubble and swelling government debts, particularly from key economies like the United States, has created a precarious environment for central bank policy.

“Markets are jittery,” Lesetja stated, noting that while asset prices have shown resilience, the precarious nature of global growth remains a concern.

“The global imbalances have widened significantly, demonstrated by China’s unprecedented trade surplus exceeding a trillion dollars last year,”

Despite these headwinds, South Africa’s economy has enjoyed a period of steady growth, with household consumption being a significant driver, surging more than 3% last year, contrary to a mere 1.3% growth for the overall economy.

The recent economic indicators suggest that South Africa has experienced a noteworthy expansion, marking four consecutive quarters of growth—the longest uninterrupted growth phase since 2018.

However, a slowdown in investment has been noted, contracting during the first half of 2025. Encouragingly, data from the third quarter shows signs of recovery in this sector.

Inflation figures reveal a promising trend as well. With the rate settling at 3.6% in December, Lesetja highlighted that it has remained close to the SARB’s 3% target. He expressed optimism, stating, “We expect this was the peak, and inflation will slow from here,”

Nonetheless, vigilance remains essential, especially regarding food inflation driven by an outbreak of foot-and-mouth disease affecting meat prices and potential hikes in electricity tariffs, an issue that could see price corrections soar from R54 billion to R76 billion.

Despite the stable consumer price index, trade union UASA spokesperson Abigail Moyo acknowledged the disappointment in the current rate holding but deemed it manageable for consumers.

Abigail reiterated that, while the SARB’s quarterly projection model indicates the possibility of rate cuts later this year, it is taking a cautious approach given the persistently high inflation risks linked to food and energy prices.

Nolan Wapenaar, Head of Fixed Income at Anchor Capital, noted that the latest inflation print, which saw a marginal increase from 3.5% in November to 3.6% in December, undershot market expectations and reflects a broader containment of inflation.

He added, ‘The key takeaway from this slightly below expectations inflation print is that most analysts expect this to be peak inflation, opening the door to further rate cuts,’

As incoming data continues to shape the monetary landscape, Lesetja has warned that the MPC will remain data-driven, assessing risks and economic conditions on a meeting-by-meeting basis. “While the risks to our inflation outlook are balanced,” he stated,

“our commitment to anchoring inflation expectations at 3% is unwavering,”

First published by Cape {Town} Etc

Compiled by Sibuliso Duba