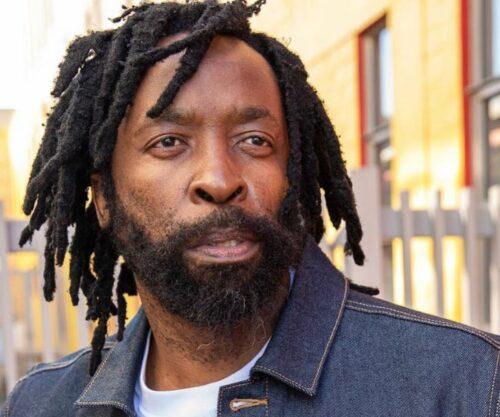

DJ Maphorisa has taken the South African Revenue Service (SARS) to the tax court regarding a R3.3 million tax dispute.

According to Sunday World, the dispute came after the government entity accused the musician, real name Themba Sekowe, of failing to submit his IRP5/IT3 certificates during a 2018 tax assessment.

However, in court documents seen by the above-mentioned publication, he reveals that the reason for the late submission was that he found himself battling with mental health issues.

Meanwhile, he revealed that he, in fact, has provided SARS with a submission of the relevant documentation, which included invoices and statements from his Standard Bank account. However, they claim that he failed to deliver more information on his FNB account.

He was therefore accused of attempting to evade tax and was imposed a 200% rate.

“Due to the appellant’s failure to respond to the audit findings, the respondent used and applied the information that was readily available to issue the letter of finalisation of audit on 20 December 2018,” the court papers stated.

According to Sunday World, a statement seen by the publication further stated, “The appellant contends that SARS failed to consider the necessary deductions (expense items) during the assessment. The appellant also claims that the imposition of the USP by Sars has been unreasonable. Additionally, the appellant maintains that he has provided sufficient evidence demonstrating that the disputed amount is not part of his gross income but consists of inter-account transfers and should not be subject to tax.”

Also see: Kabza De Small on the Phone Call That Changed His Life with DJ Maphorisa