A Month in the Life of a “Comfortable” Salary

When someone in South Africa earns R31 000 a month, many assume they’re doing okay. But one man who goes by @eds5439 walked viewers through his monthly costs, and what he had left was a shock to many.

He began with unavoidable deductions: tax at around R4 100, UIF contributions of R279, and medical aid of R1 100. Then came the big monthly hits: rent in Midrand for R6 000, a BMW car repayment of R6 500, insurance of R1 800, fuel of R3 000, groceries of R2 500, electricity of R500, and child support totalling R4 000.

When all was tallied, he had just R1 221 remaining for the rest of that month.

Empathy, Anger, and “Do Better” Advice

Once the video spread across TikTok and Facebook, South Africans responded in force. Many shared that they, too, felt squeezed, sometimes worse, on similar or even higher salaries. Some offered blunt advice: “Drop the BMW or move somewhere cheaper.” Others defended his transparency, saying he had done a public service by showing what the “middle class” really looks like now.

People pointed out how inflation, stagnant wages, and rising tax pressures are quietly eroding what most consider a stable income.

The Hidden Squeeze: Taxes That Don’t Get Noticed

Because income tax brackets were not adjusted for inflation in the 2025/26 budget, many middle earners get pushed into higher tax brackets even without a raise. That means someone earning R30 000 might find that a nominal salary increase ends up with them taking home less, or very little more, than before.

So even before rent, transport, or kids are factored in, your “net” is already under strain.

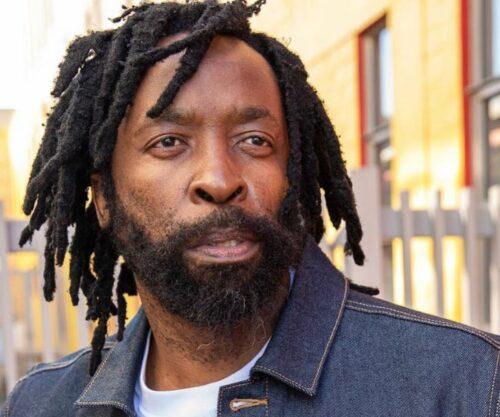

@eds5439

Why the Outrage Resonated

This isn’t just about one man’s budget. It tapped into a deeper frustration across Mzansi: that “comfortable salaries” are becoming fragile. What used to be enough is no longer. Many people feel like they’re sprinting on a treadmill; they work harder but don’t move forward financially.

Also important: this discussion validates the silent burden so many carry. Financial stress has mental health consequences, and seeing someone else be blunt about it opens the door to conversation.

A Fresh Take: What This Reveals About Mzansi’s Middle Class

This viral breakdown doesn’t just show expense lines. It shows a shifting class narrative. The middle class is thinning, pressure is creeping upward, and the buffer many once relied on has shrunk.

We’re seeing how luxury symbols, cars, apartments, and “status” expenses are becoming liabilities, not markers of success. And we’re also reminded that financial literacy, collective bargaining power, and policy reform are not optional; they are essential.

Source: Briefly News

Featured Image: Vecteezy