No More Perks Without Paying Tax: SARS Turns Its Eye to Influencers

South Africa’s social media influencers, take note: your Instagram likes and TikTok views are officially taxable. The South African Revenue Service (SARS) has made it clear that income, whether cash, gifts, travel, or product perks—is all considered taxable.

For years, influencers have thrived in what many thought was a gray zone, receiving products, trips, and services in exchange for online promotion without paying a cent in tax. But SARS is closing the loophole in 2025, and the message is firm: ignorance is no longer an excuse.

Social Media Fame Comes With Tax Responsibilities

Platforms like Modash track more than 80,000 Instagram influencers in South Africa, and when you factor in TikTok and YouTube, the actual number is likely much higher. Yet many of these digital creators—often young and new to formal business systems—are unaware that perks and gifts from brand partnerships count as income.

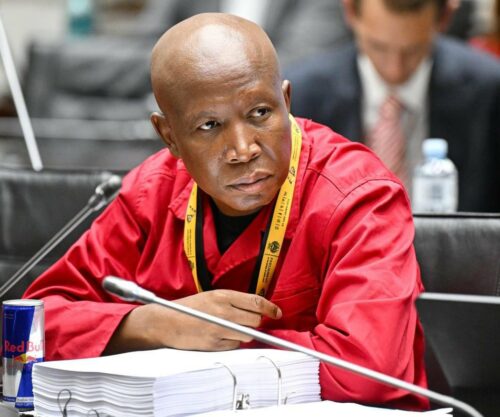

SARS Commissioner Edward Kieswetter is taking a firm stance. “No matter how social media influencers are remunerated—products, services, travel, they are deemed as income and will be taxed accordingly,” SARS stated. The agency likens influencers to sole proprietors or independent contractors, meaning they are fully responsible for declaring earnings under existing income-tax brackets.

Confusion, Concern, and Compliance

The news has sparked both panic and debate online. Many influencers admitted they were unsure whether a free holiday or gifted smartphone needed to be declared. Others questioned how non-pecuniary benefits are taxed. SARS acknowledges these challenges and is rolling out a series of educational initiatives, including videos, webinars, and seminars, to make compliance more accessible.

Full voluntary disclosure is now critical. Each influencer’s case will be handled individually, and provisional taxpayer rules may apply. While the regulations are clear, enforcement is expected to be measured, with SARS emphasizing guidance before penalties.

Social Media Reaction: Should Influencers Be Exempt?

Across Instagram, Twitter, and TikTok, opinions are split. Some argue young creators should get a grace period to understand tax obligations. Others point out that influencers operate as businesses and must be accountable, just like anyone running a small enterprise.

Local legal experts note that SARS’ approach mirrors global trends, as governments worldwide begin treating social media earnings as taxable income. South Africa is simply catching up to ensure that the booming digital economy contributes its fair share.

The Takeaway: Fame Comes With Responsibility

For influencers, 2025 marks a turning point. The era of “something for nothing” perks is over, and tax compliance is no longer optional. Those who fail to register, declare income, or report non-cash benefits risk penalties—but those who adapt can continue building careers while staying on SARS’ good side.

Whether you’re gifting followers tips on fashion, travel, or lifestyle, it’s now time to ensure your books are as polished as your content. Social media fame may open doors, but SARS wants to make sure it doesn’t leave revenue on the table.

{Source: The South African}

Featured Image: X {@CapricornFM}